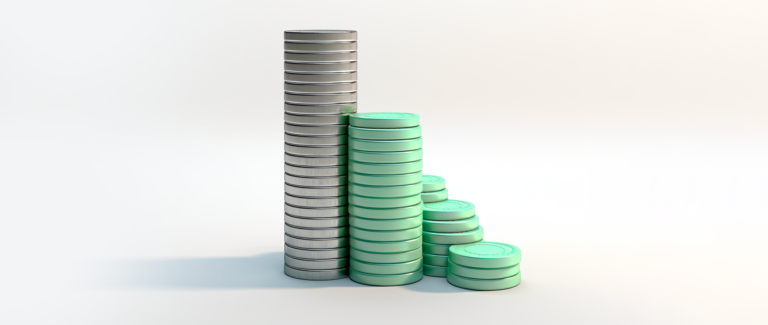

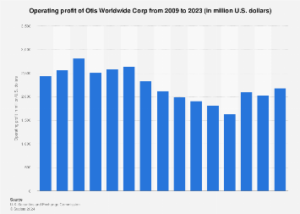

Stovec Industries, a microcap player in the textile machinery sector, has recently faced a downgrade to ‘Sell’ by MarketsMOJO as of January 3, 2025. This decision stems from the company’s poor long-term growth, with operating profit declining at an annual rate of 32.61% over the past five years. The stock is currently categorized within a Mildly Bearish range, a shift from its previous Mildly Bullish status.

Despite its small size, Stovec Industries has attracted no domestic mutual fund investments, which may indicate a lack of confidence in its current valuation or business model. On a positive note, the company maintains a low debt-to-equity ratio of 0, suggesting financial stability. Stovec has reported positive results for the last four consecutive quarters, with a profit after tax of Rs 6.68 crore, reflecting a significant growth of 157.92%.

The company boasts a return on equity of 11 and a price-to-book value of 4.9, indicating fair valuation. Over the past year, Stovec Industries has outperformed the market, generating a return of 32.52%, compared to the BSE 500’s 16.59%.